Search

Relevance of hit: 100%

back to search result indexBoard of Management Remuneration

This chapter describes the main elements of the remuneration system for the Board of Management. In addition, the Remuneration Report details the individualized remuneration of the Board of Management and the Supervisory Board of Volkswagen AG, broken down into components, as well as individualized pension provision disclosures for the members of the Board of Management.

PRINCIPLES OF BOARD OF MANAGEMENT REMUNERATION

Matters involving the remuneration system and the total remuneration of each individual member of the Volkswagen AG Board of Management are decided on by the Supervisory Board on the basis of the Executive Committee’s recommendations. The remuneration system implements the requirements of the Aktiengesetz (AktG – German Stock Corporation Act) and the recommendations of the German Corporate Governance Code (the Code) in the version dated February 7, 2017. In particular, the remuneration structure is focused on ensuring sustainable business development in accordance with the Gesetz zur Angemessenheit der Vorstandsvergütung (VorstAG – German Act on the Appropriateness of Executive Board Remuneration) and section 87(1) of the AktG.

At the beginning of 2017, the Supervisory Board of Volkswagen AG resolved to adjust the remuneration system of the Board of Management with effect from January 1, 2017. The system for remuneration of the Board of Management was approved by the Annual General Meeting on May 10, 2017 with 80.96% of the votes cast. The adjustment, in which the Supervisory Board was assisted by renowned, independent external remuneration and legal consultants, resulted in an alignment with the Group strategy.

The level of the Board of Management remuneration should be appropriate and attractive in the context of the Company’s national and international peer group. Criteria include the tasks of the individual Board of Management member, their personal performance, the economic situation, and the performance of and outlook for the Company, as well as how customary the remuneration is when measured against the peer group and the remuneration structure that applies to other areas of Volkswagen. In this context, comparative studies on remuneration are conducted on a regular basis.

COMPONENTS OF BOARD OF MANAGEMENT REMUNERATION

In this section, we provide an overview of the Board of Management’s remuneration system before going into the components of the remuneration for the reporting period.

Overview of the remuneration system

The remuneration system of the Board of Management comprises non-performance-related and performance-related components. The performance-related remuneration consists of an annual bonus with a one-year assessment period and a long-term incentive (LTI) in the form of a performance share plan with a forward-looking three-year term. The performance share plan is linked to business development in the next three years and is thus based on a multiyear, forward-looking assessment that reflects both positive and negative developments. The non-performance-related component creates an incentive for individual members of the Board of Management to perform their duties in the best interests of the Company and to fulfill their obligation to act with proper business prudence without needing to focus on merely short-term performance targets. The performance-related components, dependent among other criteria on the financial performance of the Company, serve to ensure the long-term impact of behavioral incentives.

If 100% of the targets agreed with each of the members of the Board of Management are achieved, the annual target remuneration for each member will amount to a total of €4,500,000 (corresponding to a fixed remuneration of €1,350,000, a target amount from the annual bonus of €1,350,000 and a target amount from the performance share plan of €1,800,000). The annual target remuneration for the Chairman of the Board of Management amounts to a total of €9,000,000 (fixed remuneration of €2,125,000, a target amount from the annual bonus of €3,045,000, and a target amount from the performance share plan of €3,830,000).

Annual minimum remuneration of €3.5 million (sum of fixed remuneration, annual bonus, LTI and any special payments) was contractually agreed with Mr. Sommer.

Non-performance-related remuneration

The non-performance-related remuneration comprises fixed remuneration and fringe benefits. Since 2018, separate remuneration is no longer provided for appointments assumed at Group companies, but is covered by the fixed remuneration. The fringe benefits result from noncash benefits and include in particular the use of operating assets such as company cars and the payment of insurance premiums. Taxes due on these noncash benefits are mainly borne by Volkswagen AG.

The fixed level of remuneration is reviewed regularly and adjusted if necessary.

Performance-related remuneration

The performance-related/variable remuneration consists of an annual performance-related bonus with a one-year assessment period and a long-term incentive (LTI) in the form of a performance share plan with a forward-looking three-year term (long-term incentive components) and phantom preferred shares. The components of performance-related/ variable remuneration reflect both positive and negative developments.

The Supervisory Board may cap the performance-related/ variable remuneration components in the event of extraordinary developments.

Annual bonus

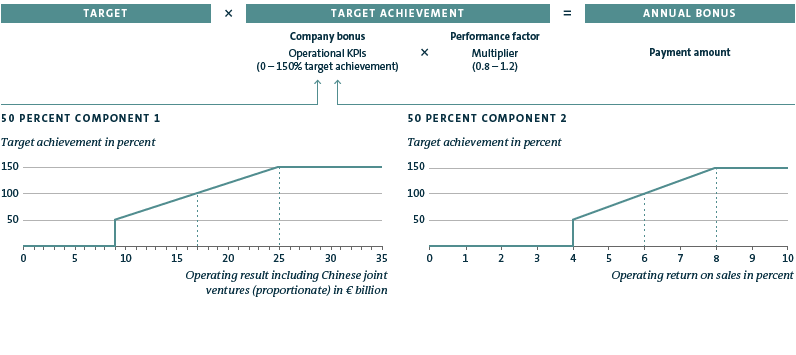

The annual bonus is based upon the result for the respective fiscal year. Operating profit achieved by the Volkswagen Group plus the proportionate operating profit of the Chinese joint ventures form half of the basis for the annual bonus, with operating return on sales achieved by the Volkswagen Group making up the second half. Each of the two components of the annual bonus are only payable if certain thresholds are reached or exceeded.

The calculated payment amount may be individually reduced by up to 20% (multiplier of 0.8) or increased by up to 20% (multiplier of 1.2) by the Supervisory Board, taking into account the degree of achievement of individual targets agreed between the Supervisory Board and the respective member of the Board of Management, as well as the success of the full Board of Management in transforming the Volkswagen Group by transferring employees to new areas of activity.

The payment amount for the annual bonus is capped at 180% of the target amount for the annual bonus. The cap arises from 150% of the maximum financial target achievement and a performance factor of a maximum of 1.2.

CALCULATION OF THE PAYMENT AMOUNT FOR THE ANNUAL BONUS

| (XLS:)

|

COMPONENT 1: OPERATING RESULT INCLUDING CHINESE JOINT VENTURES (PROPORTIONATE) |

||||

|---|---|---|---|---|

€ billion |

2018 |

2019 |

||

|

|

|

||

Maximum threshold |

25.0 |

25.0 |

||

100% level of target |

17.0 |

17.0 |

||

Minimum threshold |

9.0 |

9.0 |

||

Actual |

18.5 |

21.4 |

||

Target achievement (in %) |

110 |

127 |

||

| (XLS:)

|

COMPONENT 2: OPERATING RETURN ON SALES |

||||

|---|---|---|---|---|

% |

2018 |

2019 |

||

|

|

|

||

Maximum threshold |

8.0 |

8.0 |

||

100% level of target |

6.0 |

6.0 |

||

Minimum threshold |

4.0 |

4.0 |

||

Actual |

5.9 |

6.7 |

||

Target achievement (in %) |

98 |

118 |

||

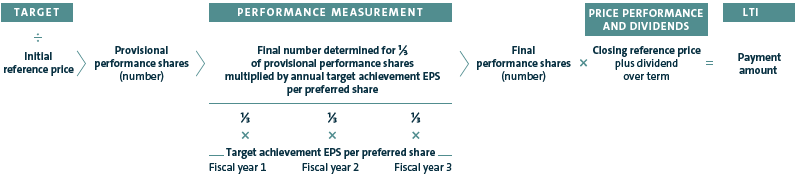

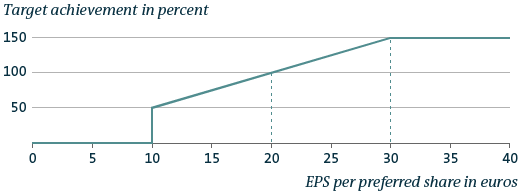

Performance share plan – long-term incentive (LTI)

The LTI is granted to the Board of Management annually in the form of a performance share plan. Each performance period of the performance share plan has a term of three years. At the time the LTI is granted, the annual target amount under the LTI is converted on the basis of the initial reference price of Volkswagen’s preferred shares into performance shares of Volkswagen AG, which are allocated to the respective member of the Board of Management purely for calculation purposes. The conversion is performed based on the unweighted average of the closing prices of Volkswagen’s preferred shares for the last 30 trading days preceding January 1 of a given fiscal year. At the end of each year, the number of performance shares is determined definitively for one-third of the three-year performance period based on the degree of target achievement for the annual earnings per Volkswagen preferred share (EPS – earnings per share per preferred share in €). A prerequisite for this is that a threshold is reached.

EPS PERFORMANCE MEASUREMENT

| (XLS:)

|

PERFORMANCE PERIOD 2017–2019 |

||||||

€ |

2017 |

2018 |

2019 |

|||

|---|---|---|---|---|---|---|

|

|

|

|

|||

Maximum threshold |

30.0 |

30.0 |

30.0 |

|||

100% level of target |

20.0 |

20.0 |

20.0 |

|||

Minimum threshold |

10.0 |

10.0 |

10.0 |

|||

Actual |

22.69 |

23.63 |

26.66 |

|||

Target achievement (in %) |

113 |

118 |

133 |

|||

| (XLS:)

|

PERFORMANCE PERIOD 2019–2021 |

||||

|---|---|---|---|---|

€ |

2018 |

2019 |

||

|

|

|

||

Maximum threshold |

30.0 |

30.0 |

||

100% level of target |

20.0 |

20.0 |

||

Minimum threshold |

10.0 |

10.0 |

||

Actual |

23.63 |

26.66 |

||

Target achievement (in %) |

118 |

133 |

||

| (XLS:)

|

PERFORMANCE PERIOD 2019–2021 |

||

|---|---|---|

€ |

2019 |

|

|

|

|

Maximum threshold |

30.0 |

|

100% level of target |

20.0 |

|

Minimum threshold |

10.0 |

|

Actual |

26.66 |

|

Target achievement (in %) |

133 |

|

After the end of the three-year term of the performance share plan, a cash settlement takes place. The payment amount corresponds to the final number of determined performance shares, multiplied by the closing reference price at the end of the three-year period plus a dividend equivalent for the relevant term. The closing reference price is the unweighted average of the closing prices for Volkswagen’s preferred shares for the 30 trading days preceding the last day of the three-year performance period. The dividend equivalent corresponds to the dividends distributed during the holding period on a genuine Volkswagen preferred share.

| (XLS:)

|

|

PERFORMANCE PERIOD |

|||||||

|

||||||||

|

2017 – 2019 |

2018 – 2020 |

2019 – 2021 |

|||||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

|||||

Initial reference price |

127.84 |

169.42 |

147.08 |

|||||

Closing reference price |

177.44 |

–1 |

–1 |

|||||

Dividend equivalent |

|

|

|

|||||

2017 |

2.06 |

– |

– |

|||||

2018 |

3.96 |

3.96 |

– |

|||||

2019 |

4.86 |

4.86 |

4.86 |

|||||

The payment amount under the performance share plan is limited to 200% of the target amount. The payment amount is reduced by 20% if the average ratio of capex to sales revenue or the R&D ratio in the Automotive Division of the last three years is smaller than 5%.

If the employment contract of a member of the Board of Management concludes prior to the end of the performance period due to extraordinary termination based on good cause, or if the member of the Board of Management starts working for a competitor (also referred to as “bad-leaver cases”), the unpaid performance shares will expire. For members of the Board of Management who held their seat as of December 31, 2016, this rule only applies in the event of a reappointment or new appointment.

In connection with the appointment of the Chairman of the Board of Management, the employment contract of Mr. Diess was terminated by mutual agreement in 2018 and a new employment contract was entered into, whereby the expiry rule described above applies from the 2018 – 2020 performance period onwards.

Ms. Werner was appointed as a member of the Board of Management in 2017. Mr. Blume, Mr. Kilian and Mr. Sommer were newly appointed to the Board of Management in 2018, followed by Mr. Schot in 2019.

In the introductory phase of the performance share plan (2017–2018), the members of the Board of Management who were Board members as of December 31, 2016 will generally receive advances of 80% of their target amount. Mr. Blume will receive corresponding advances for the performance periods 2018–2020 (proportionate) and 2019–2021. The two advances will each be paid after the first year of the performance period. Final settlement is based on actual achievement of targets at the end of the relevant three-year performance period.

CALCULATION OF THE PAYMENT AMOUNT FROM THE PERFORMANCE SHARE PLAN

| (XLS:)

|

INFORMATION ON THE PERFORMANCE SHARES |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

PERFORMANCE PERIOD 2017 – 2019 |

PERFORMANCE PERIOD 2018 – 2020 |

PERFORMANCE PERIOD 2019 – 2021 |

|||||||||

€ |

Number of performance shares allocated at the grant date |

Fair value at the grant date |

Number of performance shares allocated at the grant date |

Fair value at the grant date |

Number of performance shares allocated at the grant date |

Fair value at the grant date |

||||||

|

|

|

|

|

|

|

||||||

Herbert Diess |

14,080 |

2,048,640 |

19,212 |

2,840,468 |

26,040 |

3,350,046 |

||||||

Oliver Blume (since April 13, 2018) |

– |

– |

7,614 |

1,349,810 |

12,238 |

1,574,419 |

||||||

Jochem Heizmann (until January 10, 2019) |

14,080 |

2,031,040 |

10,624 |

1,799,918 |

335 |

43,098 |

||||||

Gunnar Kilian (since April 13, 2018) |

– |

– |

7,614 |

1,349,810 |

12,238 |

1,574,419 |

||||||

Andreas Renschler |

14,080 |

1,891,648 |

10,624 |

1,799,918 |

12,238 |

1,574,419 |

||||||

Abraham Schot (since January 1, 2019) |

– |

– |

– |

– |

12,238 |

1,574,419 |

||||||

Stefan Sommer (since September 1, 2018) |

– |

– |

3,541 |

488,446 |

12,238 |

1,574,419 |

||||||

Hiltrud Dorothea Werner |

12,907 |

1,856,672 |

10,624 |

1,799,918 |

12,238 |

1,574,419 |

||||||

Frank Witter |

14,080 |

2,025,408 |

10,624 |

1,799,918 |

12,238 |

1,574,419 |

||||||

Total |

69,227 |

9,853,408 |

80,477 |

13,228,206 |

112,041 |

14,414,075 |

||||||

| (XLS:)

|

€ |

Provision as of Dec. 31, 2019 |

Intrinsic value as of Dec. 31, 2019 |

Comprehensive income 2019 arising from performance shares |

Provision as of Dec. 31, 2018 |

Intrinsic value as of Dec. 31, 20181 |

Comprehensive income 2018 arising from performance shares |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|

|

|

|

|

|

||||||

Herbert Diess |

3,504,374 |

3,687,200 |

3,490,713 |

2,617,527 |

1,616,319 |

1,547,771 |

||||||

Oliver Blume (since April 13, 2018) |

984,260 |

– |

1,614,937 |

401,323 |

– |

401,323 |

||||||

Jochem Heizmann (until January 10, 2019) |

2,934,421 |

1,767,329 |

951,793 |

3,422,628 |

2,362,898 |

759,638 |

||||||

Gunnar Kilian (since April 13, 2018) |

2,016,260 |

– |

1,614,937 |

401,323 |

– |

401,323 |

||||||

Andreas Renschler |

5,572,774 |

3,879,394 |

1,713,961 |

5,298,813 |

2,362,898 |

1,991,565 |

||||||

Abraham Schot (since January 1, 2019) |

3,925,694 |

– |

3,925,694 |

– |

– |

– |

||||||

Stefan Sommer (since September 1, 2018) |

1,415,440 |

– |

1,317,674 |

97,766 |

– |

97,766 |

||||||

Hiltrud Dorothea Werner |

5,019,403 |

2,782,969 |

2,852,956 |

2,166,448 |

– |

1,542,922 |

||||||

Frank Witter |

6,981,087 |

3,879,394 |

2,054,256 |

6,366,831 |

2,362,898 |

2,678,125 |

||||||

Total |

32,353,713 |

15,996,286 |

19,536,920 |

20,772,660 |

8,705,012 |

9,420,432 |

The number of performance shares equals the provisional performance shares allocated at the grant date of the performance share plan. The fair value as at the grant date was determined using a recognized valuation technique.

To determine their amount, the performance shares expected for future performance periods were taken into account in addition to the provisional performance shares determined or allocated for the performance periods 2017–2019, 2018–2020 and 2019–2021. The amount therefore depends on the individual contract term and the relevant vesting arrangements for the performance shares. The intrinsic value was calculated in accordance with IFRS 2 and corresponds to the amount that the members of the Board of Management would have received if they had stepped down on December 31, 2019. Only the nonforfeitable (vested) performance shares at the reporting date are included in the calculation. The intrinsic value was calculated based on the unweighted average share price for the last 30 trading days (Xetra closing prices of Volkswagen’s preferred shares) preceding December 31, 2019, taking the dividends paid per preferred share during the performance period into account. The net value of all amounts recognized in income for the performance shares in fiscal year 2019 is recorded in “Comprehensive income 2019 arising from performance shares” according to the IFRSs.

Phantom preferred shares

The phantom preferred shares for the remuneration withheld for 2015 formed part of the Board of Management remuneration until they were paid out in 2019.

Total remuneration cap

In addition to the cap on the individual variable components of the remuneration for the members of the Board of Management, the annual benefits received according to the Code, consisting of fixed remuneration and the variable remuneration components (i.e. annual bonus and performance share plan) for one fiscal year may not exceed an amount of €10,000,000 for the Chairman of the Board of Management and €5,500,000 for each member of the Board of Management. If the total remuneration cap is exceeded, the variable components will be reduced proportionately.

Regular review and adjustment

The Supervisory Board regularly reviews and, if necessary, adjusts the level of the total remuneration cap and the individual targets.

Other agreements

Members of the Board of Management with contracts entered into on or after January 1, 2010 are entitled to payment of their normal remuneration for six to twelve months in the event of illness. Contracts entered into before that date grant remuneration for six months. In the event of disability, they are entitled to the retirement pension.

Surviving dependents receive a widow’s pension of 66 ⅔% and orphans’ benefits of 20% of the former member of the Board of Management’s pension. Contracts with members of the Board of Management whose first term of office began after April 1, 2015, provide for an entitlement – in line with the principles of the works agreement that also applies to employees of Volkswagen AG covered by collective agreements – to a widow’s pension of 60%, an orphan’s benefit of 10% for half-orphans and an orphan’s benefit of 20% for full orphans, based in each case on the former member of the Board of Management’s pension.

BENEFITS BASED ON PHANTOM PREFERRED SHARES FROM THE REMUNERATION WITHHELD FOR FISCAL YEAR 2015

At its meeting on April 22, 2016, Volkswagen AG’s Supervisory Board accepted the offer made by the members of the Board of Management to withhold 30% of the variable remuneration for fiscal year 2015 for the Board of Management members active on the date of the resolution and to make its disposal subject to future share price performance.

This was effected by first converting the amount withheld based on the average share price for the 30 trading days preceding April 22, 2016 (initial reference price) into phantom preferred shares of Volkswagen AG with a three-year holding period and, at the same time, defining a target reference price corresponding to 125% of the initial reference price. During the holding period, the holders of phantom preferred shares were entitled to dividend equivalents in the amount of the dividends paid on real preferred shares.

The shares were generally reconverted and paid out when the three-year holding period had expired or – in the event that members retired from office early – at the time they did so.

To determine the payment amount, the average share price for the 30 trading days preceding the last day of the holding period, i.e. April 22, 2019, or the date on which members left the company, was calculated (closing reference price). The difference between the target reference price and the initial reference price was deducted from the closing reference price, and the dividends distributed on one real Volkswagen preferred share during the holding period (dividend equivalent) were added to the closing reference price. The figure thus calculated was multiplied by the number of phantom preferred shares so as to calculate the amount to be paid to each Board of Management member. This ensured that – excluding the dividend equivalents accrued – the amount withheld was only paid out in full if the initial reference price of the preferred share increased by at least 25%.

In January of fiscal year 2019, Mr. Heizmann retired from the Board of Management as per contract.

The number of phantom preferred shares granted on April 22, 2016 to members of the Board of Management who were in office at the time did not change in fiscal year 2019 (as of settlement in April 2019). In the year under review, the change in fair value of the phantom shares led to the recognition of an expense of €0.1 million (previous year: total income of €0.6 million).

| (XLS:)

|

INFORMATION ON THE PHANTOM PREFERRED SHARES HELD IN 2019 |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

€ |

Number of phantom shares |

Provision Dec. 31, 2019 |

Provision Dec. 31, 2018 |

Intrinsic value Dec. 31, 2019 |

Intrinsic value Dec. 31, 2018 |

Comprehensive income 2019 arising from phantom preferred shares |

Comprehensive income 2018 arising from phantom preferred shares |

|||||||

|

|

|

|

|

|

|

|

|||||||

Herbert Diess |

4,317 |

– |

512,740 |

– |

540,704 |

27,705 |

−83,688 |

|||||||

Jochem Heizmann (until January 10, 2019) |

8,633 |

– |

1,025,361 |

– |

1,081,283 |

43,232 |

−167,356 |

|||||||

Andreas Renschler |

7,914 |

– |

939,964 |

– |

991,229 |

50,791 |

−153,418 |

|||||||

Frank Witter |

1,990 |

– |

236,357 |

– |

249,248 |

12,771 |

−38,577 |

|||||||

Total |

22,854 |

– |

2,714,422 |

– |

2,862,464 |

134,499 |

−443,040 |

|||||||

| (XLS:)

|

REMUNERATION OF THE MEMBERS OF THE BOARD OF MANAGEMENT IN ACCORDANCE WITH THE GERMAN COMMERCIAL CODE |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

2019 |

2018 |

||||||||

€ |

Non-performance- related component |

Performance- related component |

Long-term incentive component |

Total remuneration |

Total remuneration |

|||||

|

|

|

|

|

|

|||||

Herbert Diess |

2,212,694 |

4,288,002 |

3,350,046 |

9,850,742 |

7,877,832 |

|||||

Oliver Blume (since April 13, 2018) |

1,418,936 |

1,901,085 |

1,574,419 |

4,894,440 |

3,515,815 |

|||||

Jochem Heizmann (until January 10, 2019) |

71,391 |

52,085 |

43,098 |

166,574 |

5,013,141 |

|||||

Gunnar Kilian (since April 13, 2018) |

1,462,701 |

1,901,085 |

1,574,419 |

4,938,205 |

3,529,523 |

|||||

Andreas Renschler |

1,609,755 |

1,901,085 |

1,574,419 |

5,085,259 |

5,004,370 |

|||||

Abraham Schot (since January 1, 2019) |

1,810,079 |

1,901,085 |

1,574,419 |

5,285,583 |

– |

|||||

Stefan Sommer (since September 1, 2018) |

1,869,019 |

1,901,085 |

1,574,419 |

5,344,523 |

1,603,515 |

|||||

Hiltrud Dorothea Werner |

1,465,159 |

1,901,085 |

1,574,419 |

4,940,663 |

4,930,160 |

|||||

Frank Witter |

1,412,781 |

1,901,085 |

1,574,419 |

4,888,285 |

4,821,428 |

|||||

Members of the Board of Management who left in the previous year |

– |

– |

– |

– |

14,040,526 |

|||||

Total |

13,332,515 |

17,647,682 |

14,414,075 |

45,394,271 |

50,336,310 |

|||||

REMUNERATION OF THE MEMBERS OF THE BOARD OF MANAGEMENT IN ACCORDANCE WITH THE GERMAN CORPORATE GOVERNANCE CODE

The amounts shown as benefits received in the Board of Management remuneration tables in accordance with the Code correspond, in principle, to the amounts paid out for the fiscal year in question.

In the introductory phase of the performance share plan (2017 to 2018), members of the Board of Management who were Board members as of December 31, 2016 generally received advances on the target amount, which in accordance with the Code are reported in the tables as benefits received for the fiscal year in which the performance shares under the plan were allocated. Mr. Blume will receive corresponding advances for the performance period 2018–2020 (proportionate) and 2019–2021.

The amounts shown as “Benefits granted” in the Board of Management remuneration tables in accordance with the Code are based on 100% of the targets for the annual bonus and on the fair value at the grant date for the performance share plan.

| (XLS:)

|

|

HERBERT DIESS |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Chairman of the Board of Management of Volkswagen AG, |

|||||||||||||

|

|

|||||||||||||

|

Benefits received |

Benefits granted |

||||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||||

|

||||||||||||||

|

|

|

|

|

|

|

||||||||

Fixed remuneration |

2,125,000 |

1,905,414 |

1,905,414 |

2,125,000 |

2,125,000 |

2,125,000 |

||||||||

Fringe benefits |

87,694 |

76,768 |

76,768 |

87,694 |

87,694 |

87,694 |

||||||||

Total |

2,212,694 |

1,982,182 |

1,982,182 |

2,212,694 |

2,212,694 |

2,212,694 |

||||||||

One-year performance-related remuneration |

4,288,002 |

3,055,182 |

2,564,750 |

3,045,000 |

– |

5,481,000 |

||||||||

Multiyear performance-related remuneration |

540,445 |

2,603,867 |

2,840,468 |

3,350,046 |

– |

7,660,000 |

||||||||

LTI (performance share plan 2017–2019) |

– |

– |

– |

– |

– |

– |

||||||||

LTI (performance share plan 2018–2020) |

– |

2,603,867 |

2,840,468 |

– |

– |

– |

||||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

3,350,046 |

– |

7,660,000 |

||||||||

Phanton shares |

540,445 |

– |

– |

– |

– |

– |

||||||||

Total1 |

7,041,141 |

7,641,230 |

7,387,400 |

8,607,740 |

2,212,694 |

15,353,694 |

||||||||

Pension expense |

1,354,053 |

850,620 |

850,620 |

1,354,053 |

1,354,053 |

1,354,053 |

||||||||

Total remuneration |

8,395,194 |

8,491,850 |

8,238,020 |

9,961,793 |

3,566,747 |

16,707,747 |

||||||||

| (XLS:)

|

|

OLIVER BLUME |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Chairman of the Board of Management of Dr. Ing. h.c. F. Porsche AG, |

|||||||||||||

|

Eintritt: 13. April 2018 |

|||||||||||||

|

Benefits received |

Benefits granted |

||||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||||

|

||||||||||||||

|

|

|

|

|

|

|

||||||||

Fixed remuneration |

1,350,000 |

967,500 |

967,500 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||||

Fringe benefits |

68,936 |

45,999 |

45,999 |

68,936 |

68,936 |

68,936 |

||||||||

Total |

1,418,936 |

1,013,499 |

1,013,499 |

1,418,936 |

1,418,936 |

1,418,936 |

||||||||

One-year performance-related remuneration |

1,901,085 |

1,152,506 |

967,500 |

1,500,0001 |

– |

2,580,000 |

||||||||

Multiyear performance-related remuneration |

1,440,000 |

1,032,000 |

1,349,810 |

1,574,419 |

– |

3,600,000 |

||||||||

LTI (performance share plan 2018–2020) |

– |

1,032,000 |

1,349,810 |

– |

– |

– |

||||||||

LTI (performance share plan 2019–2021) |

1,440,000 |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||||

Total |

4,760,021 |

3,198,005 |

3,330,809 |

4,493,355 |

1,418,936 |

7,598,936 |

||||||||

Pension expense |

808,544 |

588,354 |

588,354 |

808,544 |

808,544 |

808,544 |

||||||||

Total remuneration |

5,568,565 |

3,786,359 |

3,919,163 |

5,301,899 |

2,227,480 |

8,407,480 |

||||||||

| (XLS:)

|

|

JOCHEM HEIZMANN |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

China |

|||||||||||

|

Left: January 10, 2019 |

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

36,986 |

1,350,000 |

1,350,000 |

36,986 |

36,986 |

36,986 |

||||||

Fringe benefits |

34,405 |

255,076 |

255,076 |

34,405 |

34,405 |

34,405 |

||||||

Total |

71,391 |

1,605,076 |

1,605,076 |

71,391 |

71,391 |

71,391 |

||||||

One-year performance-related remuneration |

52,085 |

1,608,147 |

1,350,000 |

36,986 |

– |

66,575 |

||||||

Multiyear performance-related remuneration |

1,068,593 |

1,440,000 |

1,799,918 |

43,098 |

– |

98,630 |

||||||

LTI (performance share plan 2017–2019) |

– |

– |

– |

– |

– |

– |

||||||

LTI (performance share plan 2018–2020) |

– |

1,440,000 |

1,799,918 |

– |

– |

– |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

43,098 |

– |

98,630 |

||||||

Phantom shares |

1,068,593 |

– |

– |

– |

– |

– |

||||||

Total |

1,192,069 |

4,653,223 |

4,754,994 |

151,475 |

71,391 |

236,597 |

||||||

Pension expense |

– |

– |

– |

– |

– |

– |

||||||

Total remuneration |

1,192,069 |

4,653,223 |

4,754,994 |

151,475 |

71,391 |

236,597 |

||||||

| (XLS:)

|

|

GUNNAR KILIAN |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Human Resources |

|||||||||||

|

Joined: April 13, 2018 |

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

1,350,000 |

967,500 |

967,500 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||

Fringe benefits |

112,701 |

59,707 |

59,707 |

112,701 |

112,701 |

112,701 |

||||||

Total |

1,462,701 |

1,027,207 |

1,027,207 |

1,462,701 |

1,462,701 |

1,462,701 |

||||||

One-year performance-related remuneration |

1,901,085 |

1,152,506 |

967,500 |

1,350,000 |

– |

2,430,000 |

||||||

Multiyear performance-related remuneration |

– |

– |

1,349,810 |

1,574,419 |

– |

3,600,000 |

||||||

LTI (performance share plan 2018–2020) |

– |

– |

1,349,810 |

– |

– |

– |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

Total |

3,363,786 |

2,179,713 |

3,344,517 |

4,387,120 |

1,462,701 |

7,492,701 |

||||||

Pension expense |

886,559 |

703,228 |

703,228 |

886,559 |

886,559 |

886,559 |

||||||

Total remuneration |

4,250,345 |

2,882,941 |

4,047,745 |

5,273,679 |

2,349,260 |

8,379,260 |

||||||

| (XLS:)

|

|

ANDREAS RENSCHLER |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Chairman of the Board of Management of TRATON SE, |

|||||||||||

|

|

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||

Fringe benefits |

259,755 |

246,305 |

246,305 |

259,755 |

259,755 |

259,755 |

||||||

Total |

1,609,755 |

1,596,305 |

1,596,305 |

1,609,755 |

1,609,755 |

1,609,755 |

||||||

One-year performance-related remuneration |

1,901,085 |

1,608,147 |

1,350,000 |

1,350,000 |

– |

2,430,000 |

||||||

Multiyear performance-related remuneration |

990,754 |

1,440,000 |

1,799,918 |

1,574,419 |

– |

3,600,000 |

||||||

LTI (performance share plan 2017–2019) |

– |

– |

– |

– |

– |

– |

||||||

LTI (performance share plan 2018–2020) |

– |

1,440,000 |

1,799,918 |

– |

– |

– |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

Phanton shares |

990,754 |

– |

– |

– |

– |

– |

||||||

Total |

4,501,594 |

4,644,452 |

4,746,223 |

4,534,174 |

1,609,755 |

7,639,755 |

||||||

Pension expense |

5,025,570 |

5,249,526 |

5,249,526 |

5,025,570 |

5,025,570 |

5,025,570 |

||||||

Total remuneration |

9,527,164 |

9,893,978 |

9,995,749 |

9,559,744 |

6,635,325 |

12,665,325 |

||||||

| (XLS:)

|

|

ABRAHAM SCHOT |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Chairman of the Board of Management of AUDI AG, |

|||||||||||

|

Joined: January 1, 2019 |

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

1,350,000 |

– |

– |

1,350,000 |

1,350,000 |

1,350,000 |

||||||

Fringe benefits |

460,079 |

– |

– |

460,079 |

460,079 |

460,079 |

||||||

Total |

1,810,079 |

– |

– |

1,810,079 |

1,810,079 |

1,810,079 |

||||||

One-year performance-related remuneration |

1,901,085 |

– |

– |

1,350,000 |

– |

2,430,000 |

||||||

Multiyear performance-related remuneration |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

Total |

3,711,164 |

– |

– |

4,734,498 |

1,810,079 |

7,840,079 |

||||||

Pension expense |

2,222,572 |

– |

– |

2,222,572 |

2,222,572 |

2,222,572 |

||||||

Total remuneration |

5,933,736 |

– |

– |

6,957,070 |

4,032,651 |

10,062,651 |

||||||

| (XLS:)

|

|

STEFAN SOMMER |

|||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Components & Procurement |

|||||||||||||

|

Joined: September 1, 2018 |

|||||||||||||

|

Benefits received |

Benefits granted |

||||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||||

|

||||||||||||||

|

|

|

|

|

|

|

||||||||

Fixed remuneration |

1,350,000 |

450,000 |

450,000 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||||

Fringe benefits |

519,019 |

129,020 |

129,020 |

519,019 |

519,019 |

519,019 |

||||||||

Total |

1,869,019 |

579,020 |

579,020 |

1,869,019 |

1,869,019 |

1,869,019 |

||||||||

One-year performance-related remuneration |

1,901,085 |

536,049 |

450,000 |

1,350,000 |

– |

2,430,000 |

||||||||

Multiyear performance-related remuneration |

– |

– |

488,446 |

1,574,419 |

– |

3,600,000 |

||||||||

LTI (performance share plan 2018–2020) |

– |

– |

488,446 |

– |

– |

– |

||||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||||

Total1 |

4,019,019 |

1,295,687 |

1,517,466 |

4,793,438 |

4,019,019 |

7,899,019 |

||||||||

Pension expense |

761,437 |

270,997 |

270,997 |

761,437 |

761,437 |

761,437 |

||||||||

Total remuneration |

4,780,456 |

1,566,684 |

1,788,463 |

5,554,875 |

4,780,456 |

8,660,456 |

||||||||

| (XLS:)

|

|

HILTRUD DOROTHEA WERNER |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Integrity & Legal Affairs |

|||||||||||

|

|

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||

Fringe benefits |

115,159 |

172,095 |

172,095 |

115,159 |

115,159 |

115,159 |

||||||

Total |

1,465,159 |

1,522,095 |

1,522,095 |

1,465,159 |

1,465,159 |

1,465,159 |

||||||

One-year performance-related remuneration |

1,901,085 |

1,608,147 |

1,350,000 |

1,350,000 |

– |

2,430,000 |

||||||

Multiyear performance-related remuneration |

– |

– |

1,799,918 |

1,574,419 |

– |

3,600,000 |

||||||

LTI (performance share plan 2017–2019) |

– |

– |

– |

– |

– |

– |

||||||

LTI (performance share plan 2018–2020) |

– |

– |

1,799,918 |

– |

– |

– |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

Total |

3,366,244 |

3,130,242 |

4,672,013 |

4,389,578 |

1,465,159 |

7,495,159 |

||||||

Pension expense |

956,364 |

953,404 |

953,404 |

956,364 |

956,364 |

956,364 |

||||||

Total remuneration |

4,322,608 |

4,083,646 |

5,625,417 |

5,345,942 |

2,421,523 |

8,451,523 |

||||||

| (XLS:)

|

|

FRANK WITTER |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Finance & IT |

|||||||||||

|

|

|||||||||||

|

Benefits received |

Benefits granted |

||||||||||

€ |

2019 |

2018 |

2018 |

2019 |

2019 (minimum) |

2019 (maximum) |

||||||

|

|

|

|

|

|

|

||||||

Fixed remuneration |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

1,350,000 |

||||||

Fringe benefits |

62,781 |

63,363 |

63,363 |

62,781 |

62,781 |

62,781 |

||||||

Total |

1,412,781 |

1,413,363 |

1,413,363 |

1,412,781 |

1,412,781 |

1,412,781 |

||||||

One-year performance-related remuneration |

1,901,085 |

1,608,147 |

1,350,000 |

1,350,000 |

– |

2,430,000 |

||||||

Multiyear performance-related remuneration |

249,128 |

1,440,000 |

1,799,918 |

1,574,419 |

– |

3,600,000 |

||||||

LTI (performance share plan 2017–2019) |

– |

– |

– |

– |

– |

– |

||||||

LTI (performance share plan 2018–2020) |

– |

1,440,000 |

1,799,918 |

– |

– |

– |

||||||

LTI (performance share plan 2019–2021) |

– |

– |

– |

1,574,419 |

– |

3,600,000 |

||||||

Phanton shares |

249,128 |

– |

– |

– |

– |

– |

||||||

Total |

3,562,994 |

4,461,510 |

4,563,281 |

4,337,200 |

1,412,781 |

7,442,781 |

||||||

Pension expense |

886,120 |

849,556 |

849,556 |

886,120 |

886,120 |

886,120 |

||||||

Total remuneration |

4,449,114 |

5,311,066 |

5,412,837 |

5,223,320 |

2,298,901 |

8,328,901 |

||||||

POST-EMPLOYMENT BENEFITS

In the event of regular termination of their service on the Board of Management, the members of the Board of Management are entitled to a pension, including a surviving dependents’ pension, as well as the use of company cars for the period in which they receive their pension. The agreed benefits are paid or made available when the Board of Management member reaches the age of 63. As a departure from this principle, Mr. Renschler is able to start drawing his pension when he reaches the age of 62.

The retirement provision for members of the Board of Management with a pension commitment based on final remuneration is calculated as a percentage of the fixed remuneration, starting from 50%. For Mr. Heizmann and Mr. Renschler the individual percentages rise by two percentage points for every year of service. In specific cases, credit is given for previous employment periods and retirement pensions earned. In a departure from this rule, a retirement pension entitlement of 62% of the fixed level of remuneration was set for Mr. Renschler on his appointment. The Supervisory Board has capped the percentage at 70%. These benefits are not broken down any further into performance-related components and long-term incentive components. Mr. Renschler reached a retirement pension entitlement of 70% of his fixed level of remuneration at the end of 2019. The increase in the fixed remuneration as a consequence of the remuneration system in place from fiscal year 2017 is therefore not taken into account for Mr. Heizmann and Mr. Renschler because their final salary pension commitment is based on a previous pension scheme. Current pensions are index-linked in accordance with the index-linking of the highest collectively agreed salary insofar as the application of section 16 of the Gesetz zur Verbesserung der betrieblichen Altersversorgung (BetrAVG – German Company Pension Act) does not lead to a larger increase.

For the members of the Board of Management of Volkswagen AG appointed before February 24, 2017 with a defined contribution pension scheme, a contribution rate of 50% of the fixed remuneration applies. For the members of the Board of Management of Volkswagen AG appointed after February 24, 2017 with a defined contribution pension scheme, a contribution rate of 40% of the fixed remuneration applies. The resulting amount will be credited to the pension account.

Ms. Werner, Mr. Blume, Mr. Diess, Mr. Kilian, Mr. Schot, Mr. Sommer and Mr. Witter received a defined contribution plan, which is based in principle on a works agreement that also applies to the employees of Volkswagen AG covered by collective agreements and includes retirement, invalidity and surviving dependents’ benefits. A pension contribution in the amount of 50% of the fixed level of remuneration for Ms. Werner, Mr. Diess and Mr. Witter and in the amount of 40% of the fixed level of remuneration for Mr. Blume, Mr. Kilian, Mr. Schott and Mr. Sommer is paid to Volkswagen Pension Trust e.V. at the end of the calendar year for each year they are appointed to the Board of Management. The annual pension contributions result in modules of what is, in principle, a lifelong pension in line with the arrangements that also apply to employees covered by collective agreements. The individual pension modules vest immediately upon payment to Volkswagen Pension Trust e.V. Instead of a lifelong pension, benefits can optionally be paid out as a lump sum or in installments when the beneficiary reaches retirement age – currently 63 at the earliest. Volkswagen AG has assumed responsibility for pension entitlements due to Mr. Witter from the time before his service with the Company, although these cannot be claimed before he reaches the age of 60.

On December 31, 2019, the pension obligations for members of the Board of Management in accordance with IAS 19 amounted to €60.5 (55.8) million. €13.7 (11.9) million was added to the provision in the reporting period in accordance with IAS 19. Other benefits such as surviving dependents’ pensions and the use of company cars are also factored into the measurement of pension provisions. The pension obligations measured in accordance with German GAAP amounted to €44.8 (45.9) million. Measured in accordance with German GAAP, €14.5 (9.5) million was added to the provision in the reporting period.

Retired members of the Board of Management and their surviving dependents received €32.7 (44.0) million, or €32.7 (44.0) million measured in accordance with German GAAP, in the past year. Obligations for pensions for this group of persons measured in accordance with IAS 19 amounted to €373.7 (324.0) million, or €300.5 (276.2) million measured in accordance with German GAAP.

The following general rule applies to contracts for the first term of office of members of the Board of Management entered into after August 5, 2009: the retirement pension to be granted after a member of the Board of Management leaves the Company is payable when the member reaches the age of 63.

EARLY TERMINATION BENEFITS

If the appointment to the Board of Management is terminated for cause through no fault of the Board of Management member, the claims under Board of Management contracts entered into since November 20, 2009 are limited to a maximum of two years’ remuneration, in accordance with the recommendation in section 4.2.3(4) of the Code (severance payment cap).

No severance payment is made if the appointment to the Board of Management is terminated for good reason for which the Board of Management member is responsible.

The members of the Board of Management are also entitled to a pension and to a surviving dependents’ pension as well as the use of company cars for the period in which they receive their pension in the event of early termination of their service on the Board of Management.

Please refer to notes 43 and 46 to the consolidated financial statements and the notes to the annual financial statements of Volkswagen AG for more detailed individual disclosures relating to members of the Board of Management who left the Company in fiscal year 2019.

| (XLS:)

|

PENSIONS OF THE MEMBERS OF THE BOARD OF MANAGEMENT IN 2019 (PRIOR-YEAR FIGURES IN BRACKETS) |

||||||

|---|---|---|---|---|---|---|

€ |

Pension expense |

Present values as of December 311 |

||||

|

||||||

|

|

|

||||

Herbert Diess |

1,354,053 |

5,592,969 |

||||

|

(850,620) |

(3,410,933) |

||||

Oliver Blume (since April 13, 2018) |

808,544 |

1,743,034 |

||||

|

(588,354) |

(588,354) |

||||

Jochem Heizmann (until January 10, 2019) |

– |

– |

||||

|

– |

(18,098,438) |

||||

Gunnar Kilian (since April 13, 2018) |

886,559 |

2,102,717 |

||||

|

(703,228) |

(703,228) |

||||

Andreas Renschler |

5,025,570 |

29,609,167 |

||||

|

(5,249,526) |

(20,109,236) |

||||

Abraham Schot (since January 1, 2019) |

2,222,572 |

2,222,572 |

||||

|

– |

– |

||||

Stefan Sommer (since September 1, 2018) |

761,437 |

1,228,940 |

||||

|

(270,997) |

(270,997) |

||||

Hiltrud Dorothea Werner |

956,364 |

3,482,194 |

||||

|

(953,404) |

(1,872,035) |

||||

Frank Witter |

886,120 |

14,474,204 |

||||

|

(849,556) |

(10,765,942) |

||||

|

– |

– |

||||

Members of the Board of Management who left in the previous year |

(1,053,684) |

– |

||||

Total |

12,901,219 |

60,455,797 |

||||

|

(10,519,369) |

(55,819,163) |

||||