Refinancing

REFINANCING STRUCTURE OF THE VOLKSWAGEN GROUP

as of December 31, 2019

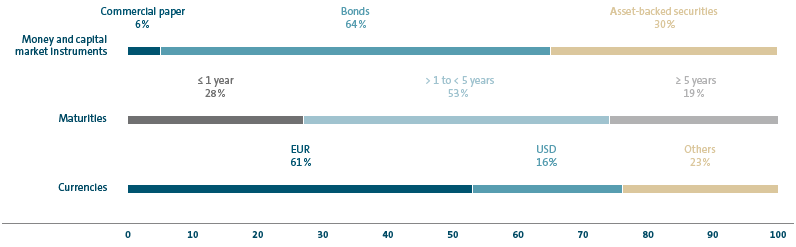

Refinancing of the Volkswagen Group is important to ensure that the Group remains solvent at all times. Cash flows from operating activities contributed to the positive development of net liquidity in 2019. Consequently, the refinancing volume through bonds on the money and capital markets for the Automotive Division declined year-on-year.

Benchmark bonds with an aggregate volume of €7.0 billion were issued for the Financial Services Division. In addition to this, private placements were issued in various currencies. In the US capital market a bond with a total volume of USD 3.0 billion was placed with investors in five tranches. Notes with a volume of CAD 1.5 billion were issued in the Canadian refinancing market.

Alongside the placement of senior, unsecured bonds, asset-backed securities (ABS) transactions were another element of our refinancing activities. ABS transactions in the amount of €2.0 billion were placed in Europe. In addition, ABS transactions were issued in USA, China and Australia among other countries.

The Volkswagen Group was also actively involved in the commercial paper market with several issuing companies.

Furthermore, Dr. Ing. h.c. F. Porsche AG issued a green promissory note loan in the amount of €1.0 billion. The proceeds of this transaction will be used to finance the all-electric Porsche Taycan vehicle project.

The proportion of fixed-rate instruments in the past year was roughly four times as high as the proportion of floating rate instruments.

In our refinancing arrangements, we generally aim to exclude interest rate and currency risk as far as possible with the simultaneous use of derivatives.

The table below shows how our money and capital market programs were utilized as of December 31, 2019 and illustrates the financial flexibility of the Volkswagen Group:

| (XLS:)

|

PROGRAMS |

Authorized volume € billion |

Amount utilized on Dec. 31, 2019 € billion |

||

|---|---|---|---|---|

|

|

|

||

Commercial paper |

42.0 |

9.0 |

||

Bonds |

162.0 |

88.5 |

||

of which hybrid issues |

|

12.5 |

||

Asset-backed securities |

92.6 |

41.1 |

Volkswagen AG’s syndicated credit line of €5.0 billion agreed in July 2011 was replaced in December 2019 by a new syndicated credit line of €10.0 billion. The new credit line has a term of five years, with the option to extend the term twice after obtaining approval from the respective banks, each for a period of one year, until 2026 at the latest. This credit facility was unused as of the end of 2019.

Of the syndicated credit lines worth a total of €10.1 billion at other Group companies, €1.4 billion has been drawn down. In addition, Group companies had arranged bilateral, confirmed credit lines with national and international banks in various other countries for a total of €6.9 billion, of which €2.4 billion was drawn down.